Author: Gareth Woodham, Associate of the Australian Property Institute, Certified Practising Valuer, Augmen Consulting

One of the early consequences of the overnight closure of our hospitality, tourism and education industries has been the impact on tenants and their ability to pay their rent. Whilst there have been a number of measures to moderate the impact on the property market, there will inevitably be declines in value in this sector. Although it is impossible to accurately predict by how much or for how long values will be impacted, we can all agree that they will inevitably fall.

Many people will also have to make choices about their properties – do they move into their now vacant investment property? What about buying out their partner or relative in the event they need access to their capital to survive the looming recession?

Whilst these sorts of decisions may appear obvious solutions to impending cashflow problems there could be significant taxation implications when changing the ownership or even just the use of an investment property.

This is why it is absolutely imperative to obtain the right advice before you make any (potentially very costly) decisions regarding your investment property.

Get the right advice

Firstly, and make sure you don’t skip this step:

- Run any decision by your accountant. They will be able to guide you with the correct advice to ensure you don’t make matters worse by exposing yourself to potentially thousands of dollars of tax, which would be the last thing anyone wants right now.

- Know where you stand. You will then need to know what your property is worth. This is critical in the decision-making process as you are making big decisions and the costs and benefits of these choices need to be assessed so you can be assured that your next step is the right one. A valuation from a Certified Practising Valuer can provide a legally binding backstop that can save tens or hundreds of thousands of dollars of Capital Gains Tax.

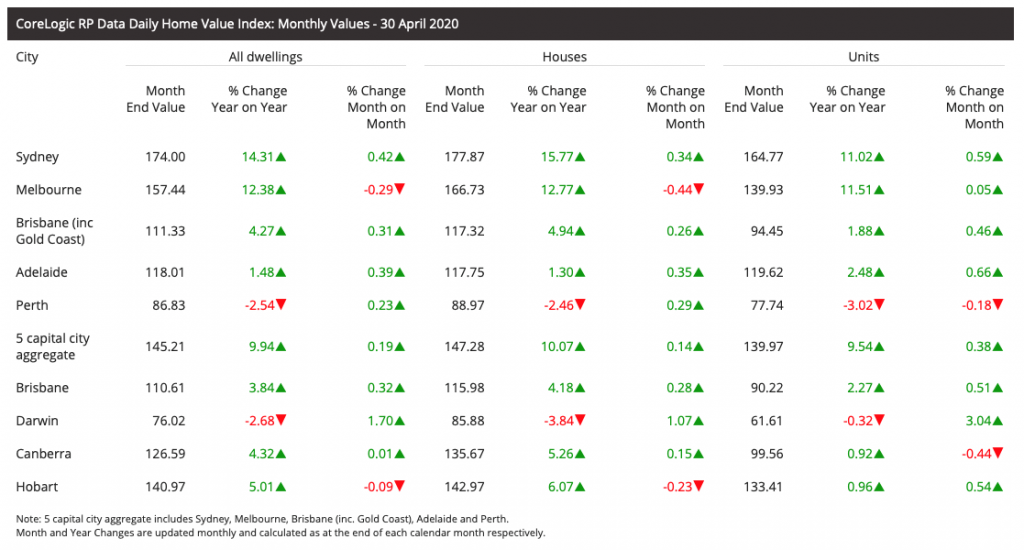

While there will inevitably be some decline in property values over the coming months, the current data for most capital cities shows annual and even monthly increases right up to 30 April 2020.

Have a look at the table below from Core Logic – Australia’s premier property data provider:

Houses and units in Sydney and Melbourne are still showing a double-digit annual growth rate. And that is only two weeks old at the time of writing.

What does this mean for you?

If you are considering a change of use, and your accountant feels that it would be advantageous to lock in a high base cost for CGT, then now would be the time to get a valuation that confirms that strong figure. Not next month when recent transactions reflect lower valuations. Do it today!

Confused? Here is an example.

This week I had a client who purchased a property almost exactly 12 months ago for $1.25m. They lived in the house while they secured a DA to redevelop the site into a pair of attached duplex dwellings. Pretty much one of the simplest developments you can do, and very popular with less experienced developers. Knowing that they had improved the value of the property by obtaining the approval and being fully cognisant of the impending drop in values over the coming months, they requested the property be valued for Capital Gains Tax purposes to establish the base cost prior to developing the site. Based upon recent sales of similar properties that have occurred prior to the lockdowns and economic uncertainty, a value of $1.65m was fully supported by the evidence, reducing their CGT liability by $400,000 at the end of their project.

What should I do?

Call your accountant today. Explain your situation and ask their advice. If you are considering any changes to how you use your property then you need to discuss this with your accountant before you:

- move in or out of an investment property, or

- re-negotiate rental, or

- acquire or dispose of a share in a property, or

- simply have plans to do something different with your property in the future, as in my example above.

Your accountant can run through the scenarios for you, but they will need a valuation as their benchmark once they have formulated the best course of action for you.

Best of all, if your accountant has any questions regarding property values and market activity, give them my number – I am always happy to take their call.

Whilst things are probably going to get worse before they get better, just remember we are all in this together, and there’s not a better place in the world to be right now than Australia. We’ve got this.

Contact Gareth

Gareth Woodham

Augmen Consulting

M: +61 (0) 410 512 320

E: gareth@augmen.com.au

W: www.augmen.com.au